The U.S. Real Estate Market in 2002: The Calm Before the Subprime Storm

Introduction

In 2002, the United States real estate market appeared to be a vibrant bright spot in an economy recovering from the dot-com bust and the shock of the September 11th attacks. Home prices were steadily climbing, homeownership rates reached record highs, and property was widely regarded as one of the safest and most profitable investments available. However, few realized that the very factors driving the 2002 boom were also laying the foundation for the global financial crisis that would unfold just a few years later. This article provides a detailed analysis of the 2002 U.S. real estate market, exploring its key drivers and the warning signs that were largely ignored.

The Macroeconomic Backdrop: A Catalyst for the Boom

To stimulate a sluggish economy, the U.S. Federal Reserve, under the leadership of Chairman Alan Greenspan, implemented a series of aggressive interest rate cuts. By the end of 2001, the federal funds rate had been slashed to a very low level, and this loose monetary policy continued throughout 2002.

The goal was to encourage borrowing and spending, thereby boosting economic growth. No sector responded more powerfully to this policy than real estate.

Evidence: “In response to the bursting of the tech bubble and the 9/11 attacks, the Federal Reserve lowered the federal funds rate eleven times in 2001, from 6.5% to 1.75%. This low-interest-rate environment was maintained through 2002, making borrowing cheaper for consumers and businesses alike.”

Source: Federal Reserve History – The Greenspan Era

Mortgage Rates Hit Historic Lows

A direct consequence of the Fed’s rate cuts was that mortgage interest rates also fell to historically low levels. For the average American, this meant the monthly cost of owning a home became more affordable than ever. Demand for housing soared, driving property values upward.

In 2002, the average rate for a 30-year fixed-rate mortgage hovered around 6-7%, an extremely attractive figure compared to previous decades.

Evidence: “The 30-year fixed-rate mortgage averaged 6.54 percent for the year 2002, a significant drop from previous years. This affordability fueled a surge in home buying and refinancing activity across the nation.”

Source: Freddie Mac – 30-Year Fixed-Rate Mortgages Since 1971

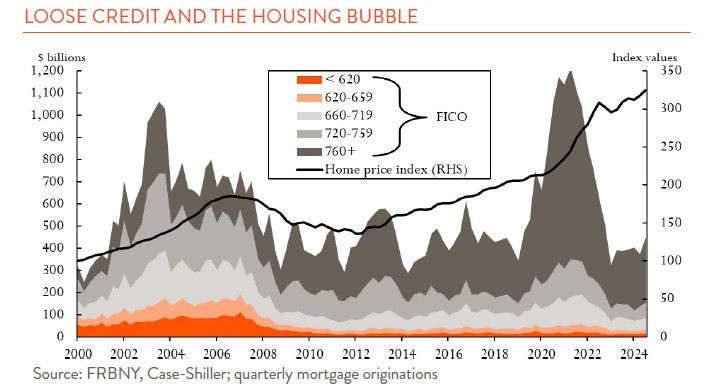

Relaxed Lending Standards and the Rise of Subprime Mortgages

Along with low interest rates, lending institutions began to loosen their underwriting standards. To maximize profits in a competitive market, banks and mortgage companies created innovative but risky loan products, most notably the subprime mortgage.

These were loans offered to borrowers with poor credit histories, unstable incomes, or an inability to provide full documentation. Subprime loans often featured low “teaser” adjustable rates that would spike dramatically after a few years. The year 2002 saw a significant expansion of this type of lending, enabling millions of previously unqualified individuals to purchase homes.

Evidence: “The seeds of the subprime mortgage crisis were sown in the early 2000s. While not yet at its peak, 2002 saw a significant expansion of subprime lending as lenders, confident in rising house prices, took on greater risks to expand their market share.”

Soaring Home Prices and a “Can’t Lose” Mentality

The combination of these three factors—low interest rates, easy credit, and high demand—created a feedback loop that sent home prices skyrocketing. In many major metropolitan areas, property values saw double-digit annual growth.

This fostered a popular investment mentality that real estate was a “can’t-lose” asset. Many people began buying homes not as a place to live, but as a speculative investment to be sold for a quick profit (a practice known as “flipping”). Investors and ordinary homeowners alike believed that even if they couldn’t afford their mortgage payments, they could always sell the house for more than they owed.

Evidence: “The S&P/Case-Shiller U.S. National Home Price Index showed a year-over-year increase of over 8% by the end of 2002. This rapid appreciation fostered a speculative environment where real estate was seen as a guaranteed path to wealth.”

Source: S&P Dow Jones Indices – S&P CoreLogic Case-Shiller Home Price Indices

Conclusion: The Seeds of a Crisis

In retrospect, 2002 was a pivotal year for the American real estate market. On the surface, it was a picture of prosperity, with rising homeownership and increasing wealth. Beneath the surface, however, the market’s foundations were becoming incredibly fragile.

The prosperity of 2002 was built on a mountain of cheap debt and lax credit standards. It inflated a massive housing bubble that, upon bursting in 2007-2008, would bring down the entire global financial system. The year 2002 stands as a clear example of how a period of calm and rapid growth can sometimes be a harbinger of a coming storm.

Sales of new single-family homes totaled 879,000 units at a seasonally adjusted annual rate (SAAR) in the first quarter of 2002, down a statistically insignificant 5 percent from the previous quarter and down 7 percent from the first quarter of 2001. The number of new homes for sale at the end of March 2002 was 311,000 units, up a statistically insignificant 1 percent from the past quarter and up 8 percent from the first quarter of 2001. At the end of March, inventories represented a 4.3 months’ supply at the current sales rate, up 16 percent from the end of the previous quarter and up 16 percent from the first quarter of 2001.

Sales of existing single-family homes for the first quarter of 2002 reported by the NATIONAL ASSOCIATION OF REALTORS® totaled 5,780,000 (SAAR), up 10 percent from the fourth quarter of 2001 and up 9 percent from the first quarter of 2001. The number of units for sale at the end of the first quarter was 2,160,000, 17 percent above the previous quarter and 10 percent above the first quarter of 2001. At the end of the first quarter, a 4.8 months’ supply of units remained, 14 percent more than the previous quarter and 9 percent above the first quarter a year ago.

**This change is not statistically significant. Sources: New: Census Bureau, Department of Commerce; and Office of Policy Development and Research, Department of Housing and Urban Development. Existing: NATIONAL ASSOCIATION OF REALTORS® |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Home Prices

Home Prices

The median price of new homes during the first quarter of 2002 increased to $182,700, up 7 percent from the previous quarter and up 8 percent from the first quarter of 2001. The average price of new homes sold during the first quarter of 2002 was $224,400, up 5 percent from the fourth quarter of 2001 and up 6 percent from the first quarter a year ago.

The median price of existing single-family homes in the first quarter of 2002 was $150,900, 2 percent higher than the fourth quarter of 2001 and 8 percent above the same quarter a year ago, according to the NATIONAL ASSOCIATION OF REALTORS®. The average price of existing homes, $190,900, increased 3 percent from the previous quarter and was 8 percent greater than in the first quarter of 2001.

1 The quarterly data series for the “constant-quality house” has been discontinued by the Census Bureau. Annual data are still being published. The values for the set of physical characteristics used for the constant-quality house have been revised based on a 1996 base year. |

||||||||||||||||||||||||||||||||||||||||||||||||

Housing Affordability

Housing Affordability

Housing affordability is the ratio of median family income to the income needed to purchase the median priced home based on current interest rates and underwriting standards, expressed as an index. The NATIONAL ASSOCIATION OF REALTORS® composite index value for the first quarter of 2002 shows that families earning the median income have 137.3 percent of the income needed to purchase the median-priced existing home. This figure is down 3 percent from the fourth-quarter 2001 index and down 2 percent from the first quarter of 2001.

The first-quarter 2002 decrease in the housing affordability index is the result of changes in the marketplace. The national average home mortgage interest rate for existing single-family homes has increased 15 basis points from the previous quarter to an interest rate of 6.86 percent. The median price of existing single-family homes increased 2.0 percent from the fourth quarter of 2001, while the median family income rose just 1.0 percent from the previous quarter.

The fixed-rate index decreased 3 percent from the fourth-quarter 2001 index and decreased 3 percent from the first quarter of 2001 as well.

|

Apartment Absorptions

Apartment Absorptions

There were 46,800 new, unsubsidized, unfurnished, multifamily (5 or more units in structure) rental apartments completed in the fourth quarter of 2001, down 17 percent from the previous quarter and down a statistically insignificant 13 percent from the fourth quarter of 2000. Of the apartments completed in the fourth quarter of 2001, 59 percent were rented within 3 months. This absorption rate is 9 percent below the previous quarter and 12 percent below the same quarter of the previous year. The median asking rent for apartments completed in the fourth quarter was $843, which is a statistically insignificant 6 percent below the previous quarter and a statistically insignificant 2 percent below a year earlier.

In all of 2001, 192,500 apartments were completed, of which 64 percent were rented within 3 months. The median asking rent was $876. This represents a 15-percent decrease in completions, an 11-percent decrease in absorptions, and a 4-percent increase in median rent.

**This change is not statistically significant. Sources: Census Bureau, Department of Commerce; and Office of Policy Development and Research, HUD. |

Manufactured (Mobile) Home Placements

Manufactured (Mobile) Home Placements

Manufactured homes placed onsite ready for occupancy in the fourth quarter of 2001 totaled 184,000 at a seasonally adjusted annual rate, a statistically insignificant 3 percent below the level of the previous quarter and 12 percent below the fourth quarter of 2000. The number of homes for sale on dealers’ lots at the end of the fourth quarter totaled 65,000 units, unchanged from the previous quarter but 7 percent below the same quarter of 2000. The average sales price of the units sold in the fourth quarter was $49,600, a statistically insignificant 2 percent above the previous quarter and 6 percent above the fourth-quarter 2000 price.

In 2001, 186,000 manufactured homes were placed, a decrease of 32 percent from 2000. The average sales price, $49,400, was an increase of 6 percent from the previous year.

**This change is not statistically significant. Sources: Census Bureau, Department of Commerce; and Office of Policy Development and Research, HUD. |

Builders’ Views of Housing Market Activity

Builders’ Views of Housing Market Activity

The National Association of Home BuildersTM (NAHB) conducts a monthly survey focusing on builders’ views of the level of sales activity and their expectations for the near future. NAHB uses these survey responses to construct indexes of housing market activity. (The index values range from 0 to 100.) The first-quarter value for the index of current market activity for single-family detached houses stood at 64, up 9 points from the fourth quarter of 2001 and up 2 points from 2001’s first quarter. The index for future sales expectations, 68, was up 10 points from the fourth-quarter 2001 value and up 4 points from 2001’s level. Prospective buyer traffic had an index value of 47, which is up 8 points from the fourth-quarter 2001 value and up 6 points from 2001’s first-quarter level. NAHB combines these separate indices into a single housing market index that mirrors the three components quite closely. In the first quarter, this index stood at 59, which is up 8 points from the fourth-quarter 2001 level and up 2 points from the value in 2001.

|

read more: https://www.thegalecompany.com/